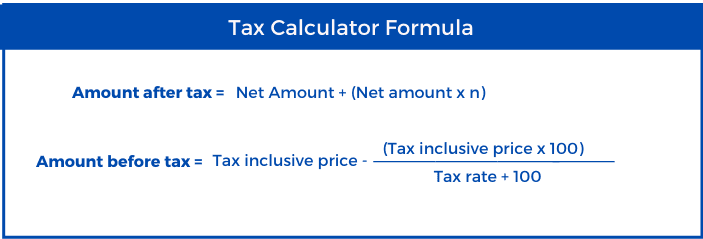

For easy understanding these have been grouped into heads as given below. The following example will enable you to understand the working of the GST formula.

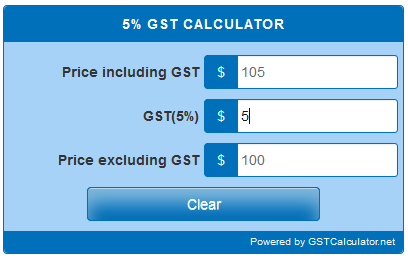

5 Percent Gst Calculator Gstcalculator Net

Similarly an offence under GST is a breach of the provisions of the GST Act and Rules.

. What are the offences under GST. It is an indirect sales tax applied to certain goods and services at. Currency converter VAT Calculator US Sales Tax Company financial ratios Percentage calculator Points scoreboard BMI Calculator Minigolf scorecard Footdisc golf scorecard Tennis Scoring Metabolic weight Coin flip Word counter Character counter.

Pos Malaysias Integrated Parcel Centre IPC is Shah Alam was upgraded with an increased processing capacity from 112000 to 300000 items a day. GST Calculator GST shall be levied and charged on the taxable supply of goods and services. If you supply or receive an invoice that only has a figure at a wine equalisation tax-goods services tax WEG label you need further information to claim GST credits and for it to be considered a valid tax invoice.

AGENCY Browse other government agencies and NGOs websites from the list. Crisis 2 VAT cut on basics is withdrawn. Goods and Services Tax GST The Goods and Services Tax GST is similar to VAT.

1 Jan 2023. DOWNLOAD Download form and document related to RMCD. Sales tax on low-value import consignments.

When has anyone committed an offence under GST. As a result you will get the Net price GST and Gross price. GST is levied on most transactions in the production process but is refunded with exception of Blocked Input Tax to all parties in the chain of production other than the final consumer.

Further you can also file TDS returns generate Form-16 use our Tax Calculator software claim HRA check refund status and generate rent receipts for Income Tax Filing. Also check the sales tax rates in different states of the US. Tax invoices sets out the information requirements for a tax invoice in more detail.

1 Jan 2023. We all know that the formula for finding GST amount is Supply value x GST Now well insert values in the formula for better understanding. EVENT CALENDAR Check out whats happening.

1 Jan 2023. But if you begin selling internationally it can be helpful to know which countries have GST. COMPLAINT.

This best payroll software in Malaysia is so convenient that you can pay your employees from anywhere anytime. GST exemption withdrawn on e-commerce imports. GST Calculator This page was last edited on 4.

Please visit the VAT Calculator. There are 21 offences under GST. Segala maklumat sedia ada adalah untuk rujukan sahaja.

There are 16 mandatory GST invoice details required. Check With Expert GST shall be levied and charged on the taxable supply of goods and services. Actpay includes a special feature that allows you to verify PCB calculations using the LHDN online PCB calculator.

Check With Expert GST shall be levied and charged on the taxable supply of goods and services. An offence is a breach of a law or rule ie an illegal act. Our GST calculator uses the basic formula for calculating the GST amount.

A registered person must issue a tax invoice before or at the time of sales. Increases GST to 8. Sehubungan dengan itu sebarang pertanyaan dan maklumat lanjut berkaitan GST sila hubungi Pusat Panggilan Kastam 1-300-888-500 atau emailkan ke ccccustomsgovmy.

GSTR 20131 Goods and services tax. REGISTER LOGIN GST shall be levied and charged on the taxable supply of. GST Calculator is an online web application where you can add or subtract goods and service tax to any given price.

To date roughly 160 countries have adopted a GST or VAT scheme according to data provided by the Malaysian governments Treasury department. Free calculator to find the sales tax amountrate before tax price and after-tax price. Today Pos Malaysia is the national courier service provider and sole licensee for universal postal services in the country delivering to more than 10 million addresses across the nation.

Malaysia Sales and service tax. Taxable and non-taxable sales. REGISTER LOGIN GST shall be levied and charged on the taxable supply of.

Adalah dimaklumkan bahawa Portal MyGST ini tidak lagi dikemaskini semenjak GST dimansuhkan pada 31 Ogos 2018. GST compliance cloud solutions that is designed for small and medium businesses. Just enter the price in the input box and press the Add GST or Subtract GST buttons.

Which Countries Charge GST. The Goods and Services Tax GST is an abolished value-added tax in Malaysia. 1 Jan 2023.

Citizen Gst Calculator Apps On Google Play

Citizen Gst Calculator Apps On Google Play

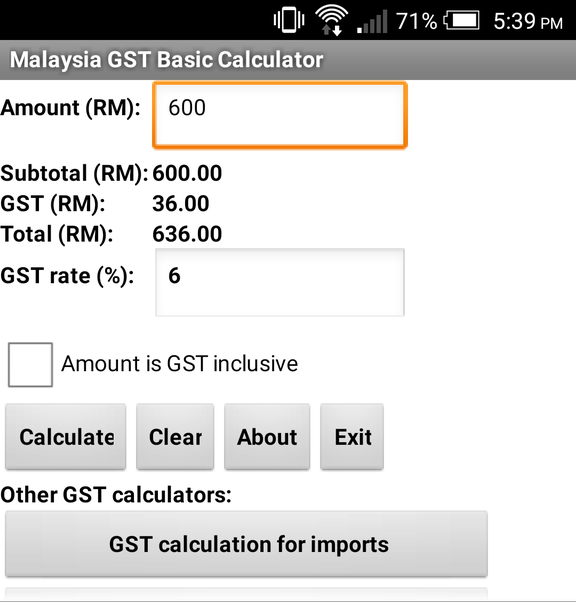

Gst Calculator Apk For Android Download

Citizen Calculator Gst Calculator Apk Pour Android Telecharger

Calculating The Gst Paid On An Item Youtube

Malaysia Gst Guide For Businesses

Gst Calculator Apk For Android Download

Gst Gold Calculator Apk Pour Android Telecharger

Free Gst Calculator Tool And Gst Return Filing Reach Accountant Procedure And Compliances To Be Followed For Calculating And Filing Gst Returns How Reach Helps In The Process Of Filing And Calculating

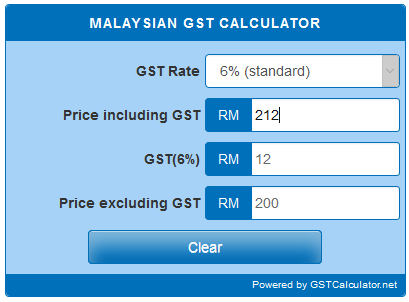

6 Percent Gst Calculator Gstcalculator Net

Gst Rates In Malaysia Explained Wise

Malaysian Gst Calculator Gstcalculator Net

Vat Gst Tax Calculator Free Tool Bookspos

Citizen Gst Calculator Apps On Google Play

4 Gst Apps To Help You Calculate Compare Prices And File Complaints